Transforming Finance with AI

Getting your Finance transformation off the ground, using data and analytics effectively.

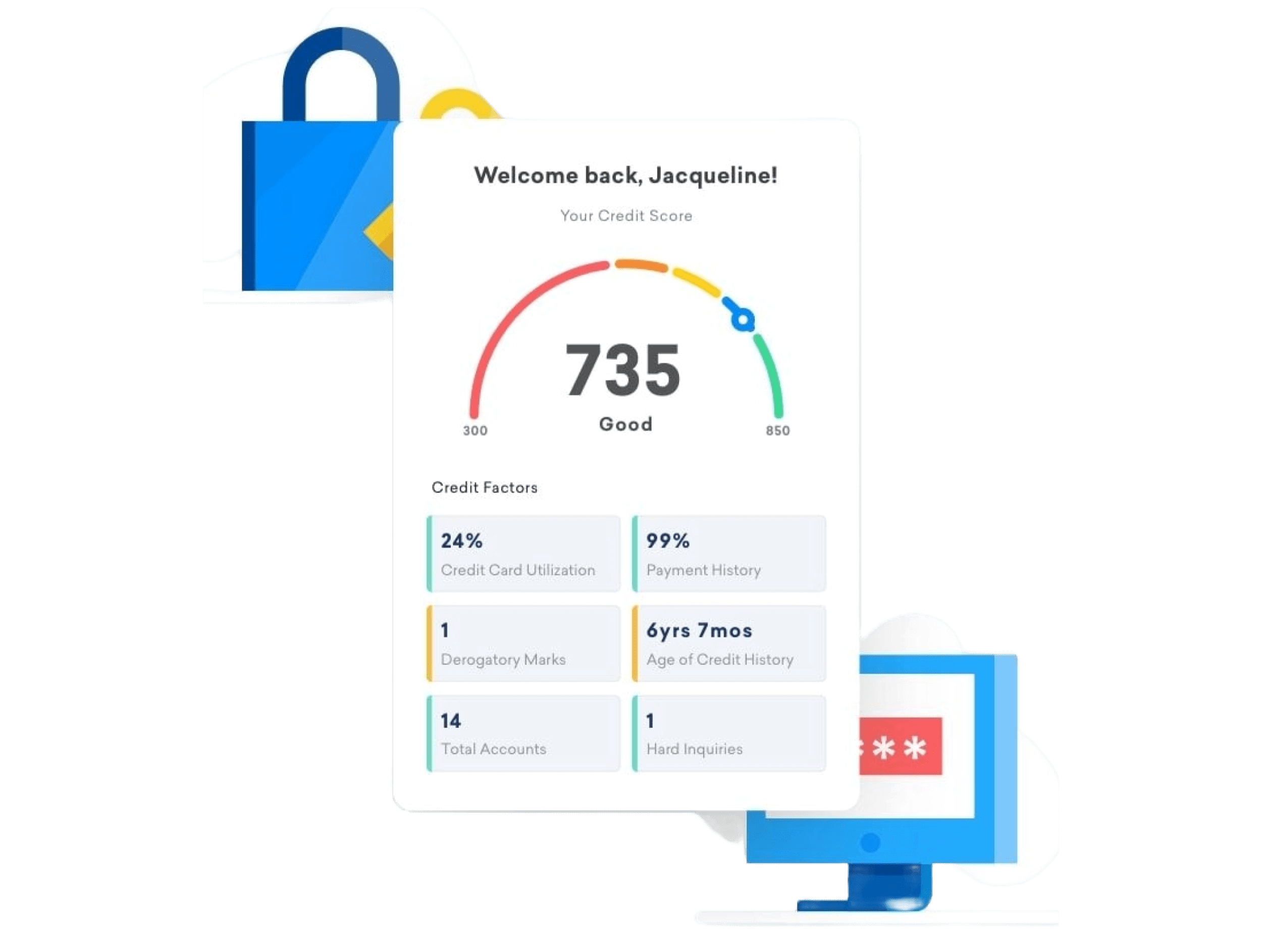

Automatic credit scoring

(5.0)

Automatic credit scoring is the process of using statistical models and algorithms to assess the creditworthiness of individuals or businesses applying for credit. Credit scoring is a crucial component of the lending and financial industry, as it helps lenders make informed decisions about whether to approve or deny credit applications and what terms (such as interest rates) to offer to borrowers.

Key Features

- 1Extract and process information from customers' bank statements in PDF format

- 2Extract data from both Text and image

- 3Offline Functionality for improve security

- 4Giving a final credit score based on the performance of bank statements

Values

- 1Unbiased data entry

- 2Data driven decision making

- 3Operational cost reduction

Technologies Used

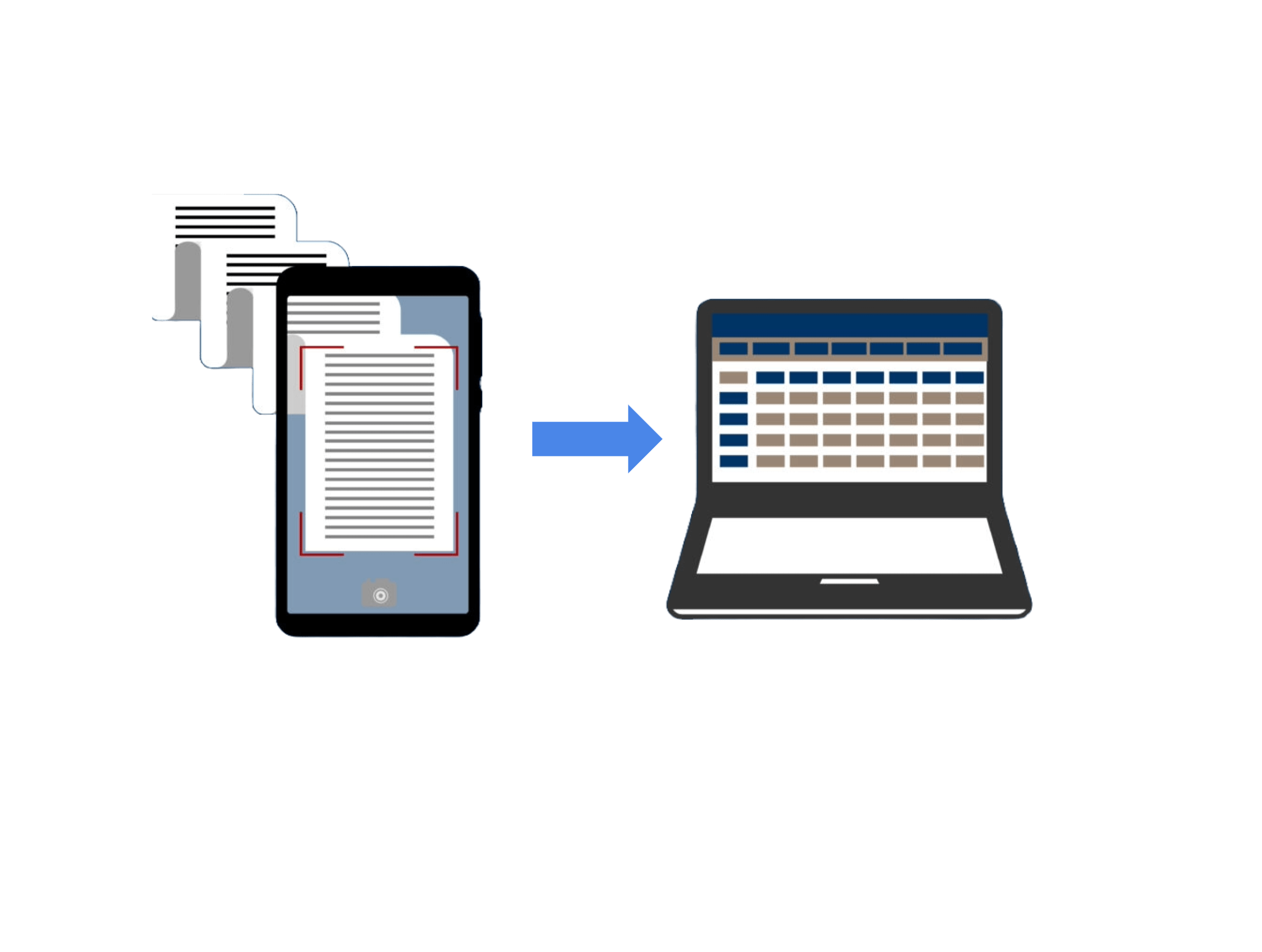

Automatic Life Insurance Claiming with OCR

(5.0)

Insurance companies are encountering difficulties in extracting and processing information from their customers' medical bills. The current manual process is time-consuming, error-prone, and causing delays in customer service, along with increased operational costs. Especially, they face a specific challenge where the bills from one customer is totally different from another customer.

Key Features

- 1Extract key value pairs and table values from documents

- 2Support PDF, TIFF inputs

- 3Process local folders and SFTP folders

- 4Fully offline

Values

- 1Efficiency

- 2Flexibility

- 3Operational Cost Reduction

- 4Offline functionality

Technologies Used

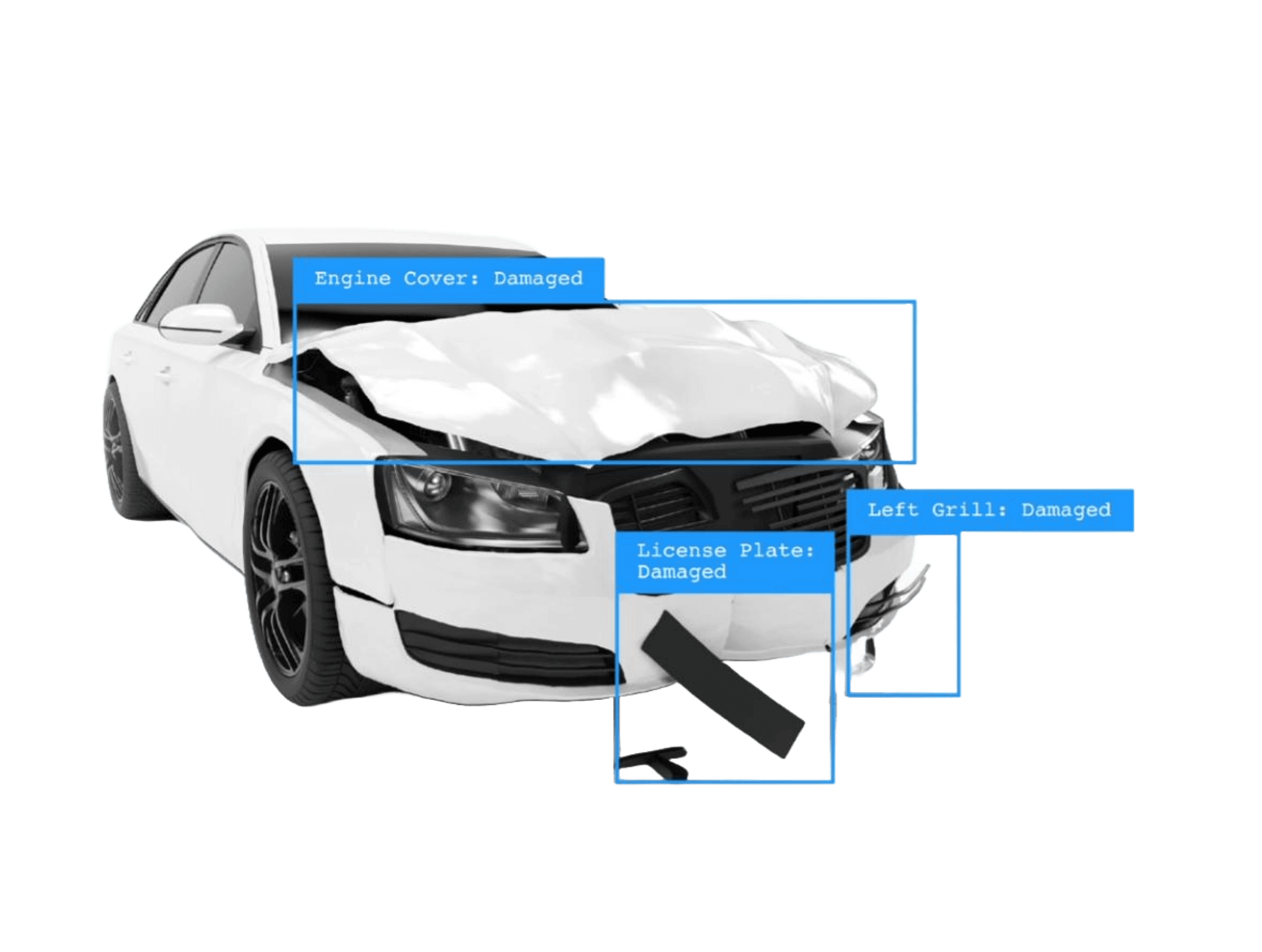

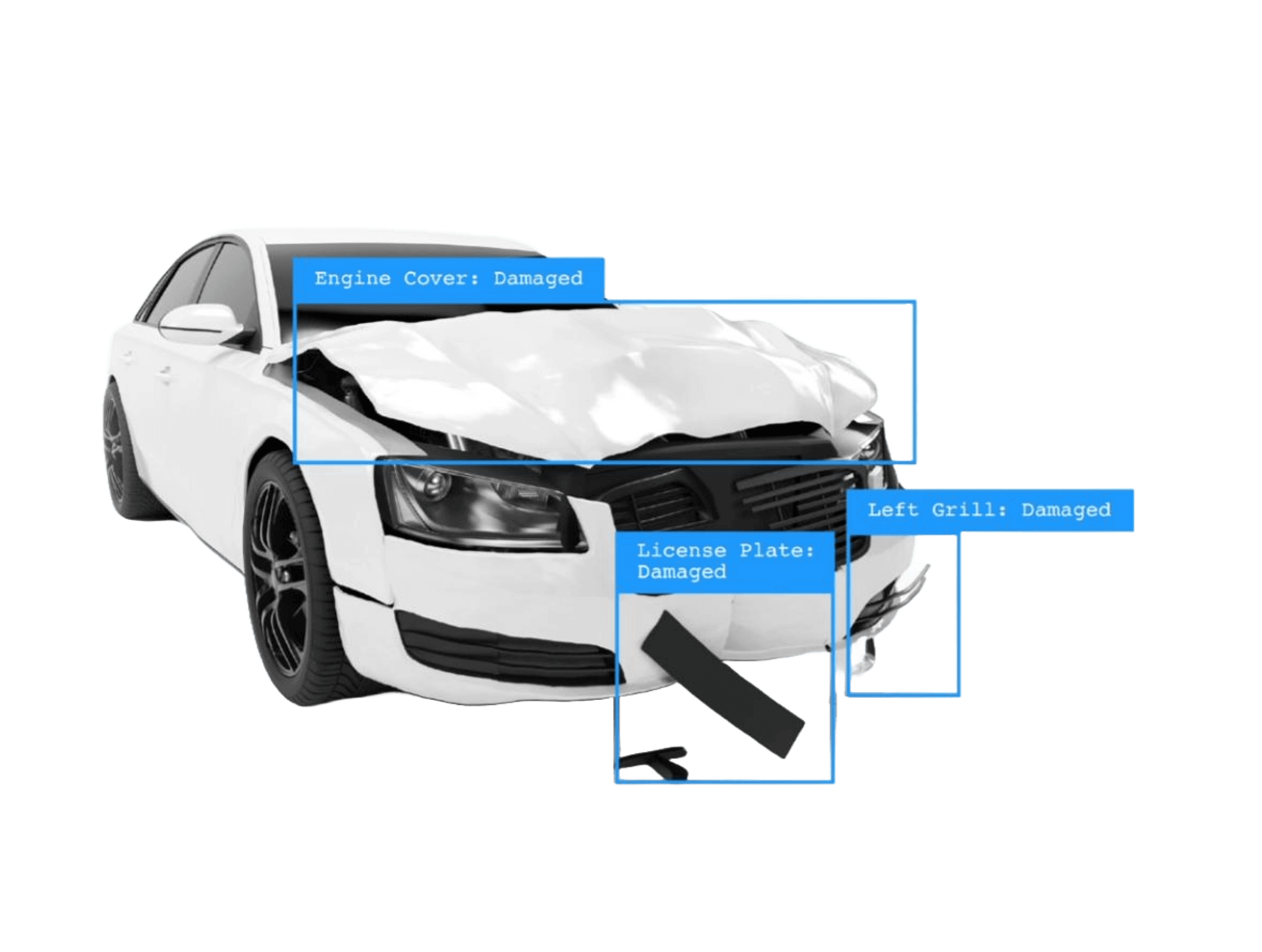

Computer vision based Damage claim valuation

(5.0)

An emerging technology that uses computer vision, machine learning, and image analysis techniques to assess and estimate the extent of damage to vehicles, properties, or other assets for insurance claims in an automated way.

Key Features

- 1Fast image processing

- 2Automated Inspection

Values

- 1Accuracy

- 2Speed

- 3Cost - effectiveness

Technologies Used

Automated Customer engagement Chatbot using private commercial LLM

(5.0)

A smart chatbot that talks with customers and helps with placing orders using advanced technology. SenzMate has upgraded the chatbot by using powerful language models like Llama2-7B, replacing the old ones. The chatbot is now deployed on the client's server, making it easy to use and accessible for both the company's team and customers.

Key Features

- 1More intelligent and natural conversation with customers

- 2Enhanced customer experience

Values

- 1Improved customer service

- 2Improved Efficiency and usability

Technologies Used

Resources

Mosurance for Usage Based Insurance

Mosurance is a telematic solution provider for the Insurance industry which builds a vehicular network using it’s OBD2 based devices. These devices sends sensor data in real-time directly to the “MAGMA” IoT platform where the magic...

Smart Insurance Card: The new normal of Vehicle Insurance

Having an insurance premium is a strict government rule for all the vehicles. It has been practiced for a long time and the way we do it hasn't evolved so far. Along with the driving license and tax payment receipt we carry our insurance...